MicroLED displays show great promise, as the technology enables emissive displays that can offer performance on par with OLED displays and higher brightness and efficiency. In addition, these displays can offer higher lifetimes and less burn-in.

However, the production of microLED displays is still very challenging - with many issues that are yet to be resolved - around the LED epiwafer growth, the transfer process, RGB backplanes, inspection and repair, and more. Even after billions of dollars that have gone into microLED display technologies R&D, display makers are not ready for actual mass production.

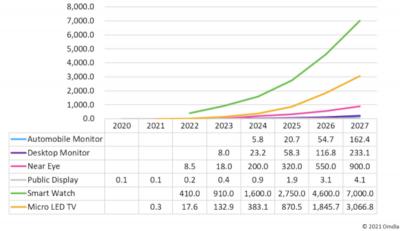

MicroLED displays are suitable for many display applications - AR/VR microdisplays, simple displays for fitness bands, smartwatches, smartphones, tablets, IT displays and of course TVs and even large-area format displays. Interestingly, looking at the display industry split by display size, it currently seems as if the first applications to be commercialized are on both ends of the spectrum - AR displays, small simple displays (for fitness bands, automotive HVAC displays, etc) and large-area TVs.

Most analysts agree that microLED displays will find a market, and that the industry will experience fast growth starting in the near future. But the question remains - when will microLEDs be commercialized? Some believe that actual mass production of displays in a meaningful way will not happen before 2030 or so. Some are more optimistic, seeing mass production starting in about 3-5 years.

Our own opinion is that microLEDs may find applications in some niche areas in the near future - we see small passive-matrix displays for premium devices as the first possible application, followed by large-area TVs and finally microdisplays for AR/VR.

All of these applications do not require, however, large amounts of displays. These are all quite niche applications in terms of number of units, and in terms of display area (AR could be an exception, if this new application takes off as some analysts foresee).

Omdia, for example, sees around 5 million microLED displays shipping in 2025, which will generate around $7 billion in revenues. By 2027, the market will grow to over $11 billion in revenues. These are large revenues - but keep in mind that compared to the total display industry (estimated at over $200 billion) it is relatively low.

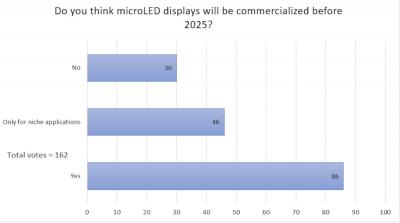

Personally, we don't like giving forecasts, but it is likely that many years will pass before we see meaningful microLED display production in major applications. We did run a poll on our social media channels (Twitter and LinkedIn), the results of which you can see above. Most people do believe that microLED displays will be here before 2025 - but then again this depends on how you define "mass production" in the display industry.

Most people agree that microLED displays aren't here yet due to the technical challenges still facing the industry. There is, however, another reason why microLED display adoption may be further away than we realize. Even if microLED displays can produced at large enough volumes, will the benefits of microLED technology be enough to convince consumers and device makers to switch from OLED displays? Especially if costs are higher?

The main benefits of microLED displays, as we said above, are the high brightness, efficiency and lifetime.

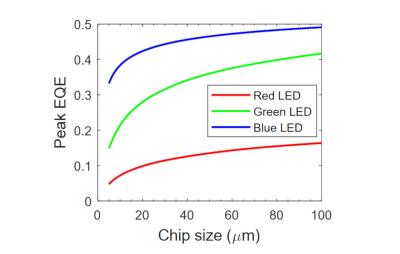

High-efficiency is crucial, but mostly for mobile applications. For monitors and TVs, this is less so. In addition, as we already covered in a previous article, as the LED chips get smaller, the efficiency drops. In addition, when viewing the total display system efficiency, the benefits of microLEDs are not dramatic - and may only reach 20-30% improvement in power consumption over state-of-the-art OLEDs.

Display lifetime is indeed a problem for current OLEDs, as the emissive nature of OLEDs coupled with its limited lifetime results in image retention - or burn-in. The lifetime of in-organic LEDs is much higher than that of their organic counterparts - which means that image retention in microLED displays won't be as common as it is in OLED displays.

But how much of a problem is burn-in, really? Currently OLED makers are producing over 400 million smartphone AMOLED panels each year, which are adopted by all leading phone makers, including Apple, Samsung, Huawei and Xiaomi. Many people replace their phones after 2-3 years, and actual cases of smartphone display burn-in aren't really that common. Will consumers pay more for a display just because it is less likely to feature a problem that they do not really experience?

The same goes for TVs, tablets and laptops - millions such devices are produced each year with OLED displays, and consumers are quite happy with them. I can personally say that I have a 2016 LG OLED TV, and have had my share of OLED smartphones - none of which demonstrated any burn-in so far.

So, microLEDs do offer a meaningful advantage of high brightness and high efficiency, and this may enable it to penetrate markets in which these are real pain points - AR comes to mind, and also wearable displays. And this is indeed display segments for which analysts are optimistic for microLED adoption.

Another interesting aspect of MicroLED technology is that it enables innovative display architectures (for example a seamless tiled display) and business models (breaking down display production into several stages, which cannot really be done with OLED or LCD production). We may be surprised by the implications of these innovations.