MicroLED technology is a next-generation emissive display technology that promises highly efficient and bright displays that offer superior image quality with infinite contrast and a wide color gamut.

MicroLED can be applied to displays of many kinds - from small displays for smartwatches and AR devices to large-area TV displays. MicroLED displays are often compared to OLED displays - the main display technology that it is rivaling.

What is an OLED?

OLED is the current premium emissive display technology, already adopted in many mobile devices, wearables and even TVs. In 2023 over 800 million OLED displays shipped to companies such as Samsung, Apple, LG, Sony and others. OLEDs can be made flexible, foldable and even rollable and the displays offer the best image quality currently in production.

MicroLEDs vs OLEDs

OLEDs use tiny sub-pixels made from organic emissive materials. Micro-LEDs are somewhat similar - but with an inorganic LED structure. Compared to OLEDs, Micro-LEDs promise to be much more efficient and bright, more durable (higher lifetime) and with a higher color gamut, mostly due to the superior performance of LEDs over their organic counterparts.

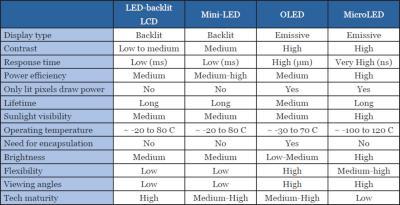

The following table shows a comparison between OLEDs and MicroLEDs (it also details mini-LEDs and regular LCDs):

As can be seen, microLEDs has the potential to beat OLEDs in most metrics, including power consumption, lifetime, brightness, temperature range and response time.

The main drawback of MicroLED technology is that it is not mature yet, and there are still challenges on the way towards commercialization, as current production costs are extremely high. It is believed that within 3-5 years microLEDs will be able to compete with OLEDs in some early markets (mostly wearables, near-eye microdisplays and ultra large-area TVs), and in the long term microLEDs represent the future of the display industry.

MicroLED-Info releases a new version of the Transparent MicroLED and OLED Market report

Today we published a new edition of our Transparent MicroLED and OLED Market Report, with all the latest information and updates from this interesting upcoming industry and market, including the many new prototypes and displays recently unveiled by microLED developers.

Reading this report, you'll learn all about:

- Transparent OLED and MicroLED properties and advantages

- The transparent OLED and MicroLED industry

- What kind of transparent OLEDs are currently on the market

- The transparent OLED lighting market

The report package also provides:

- Transparent OLED display product listing

- A guide into buying transparent OLEDs

- The main challenges towards transparent displays

- Free updates for a year

This transparent displays market report provides a great introduction to transparent OLED and MicroLED technologies and covers everything you need to know about the market and industry now and in the future. This is a great guide for anyone who's thinking about adopting transparent displays in their products or that wants to understand this industry and market throughout.

Why MicroLED is Poised to Revolutionize Wearable Technology

This is a guest article by Dr. Reza Chaji, founder and CEO, VueReal

Imagine a future where your smartwatch evolves from a timepiece to a powerful digital hub, seamlessly integrating all aspects of your life. The potential for smartwatches to become central to daily routines is immense, especially with AI and cutting-edge technologies.

These advanced technologies enable smartwatches to support seamless communication, health and fitness tracking, environmental awareness, biometric security, and more. As a result, smartwatches are becoming indispensable tools that enrich our lives and enhance our health and security in an interconnected world.

An interview with Justin Brown - X Display's Executive Vice President Operations & Equipment

Justin Brown is X Display's Executive Vice President for Operations & Equipment. Justin leads the company’s supply chain development, manufacturing partner relationships and also its Equipment division, which provides mass-transfer equipment for XDC’s partners and licensees. Justin was kind enough to answer a few questions we had for XDC.

Q: Hello Justin, thanks for your time. XDC has been a bit quiet in the last few years. Can you bring us up to date on your microLED technologies, processes and products?

Thank you for the opportunity to share the progress at XDC. We have been busier in the near past than ever before. As you know, we first announced our MicroIC technology, our mass transfer process, our manufacturing equipment and the uniqueness of our approach, the IP strength we possess and the experience of the team. This led to broad customer visibility and we narrowed down our efforts to a select set of partners that we are currently working with. We have deep engagements with customers that we anticipate will result in end product announcements in the future.

Driving Innovation: The Transformative Potential of MicroLEDs in Automotive Displays

The MicroLED Industry Association published today a new white paper, that is focused on microLED automotive displays.

One of the key markets for microLED developers is the automotive market, as microLED displays provide strong benefits over existing technologies, and the luxury automotive segment makes it possible to adopt next generation display technologies even at low volume and relatively high prices.

This white paper focuses on the automotive industry, explains the need for next-generation displays, and details the latest automotive display prototypes and technologies. The white paper also includes a discussion OLED technology challenges, the opportunities for microLED developers and a detailed look into the different display types used in the automotive industry.

First impressions from SID Displayweek 2024

The display industry's premier event, Displayweek, is over. We will now collect our notes, thoughts, photos and images and will share it all in the coming days. In the meantime, we'd like to detail some initial impressions.

Generally speaking, it seems as if the display industry is going through a phase of relatively little innovation, especially with the mature LCD and OLED industry segments. While it has been a very busy week, and attendance at the event seems high, the number of actual demonstrations and prototypes was not stellar and compared to previous years, the booths were smaller and some companies skipped the event this year or preferred to only show their latest displays in private settings. Some thoughts we have:

MicroLED-Info releases a new version of the Transparent MicroLED and OLED Market report released

Today we published a new edition of our Transparent MicroLED and OLED Market Report, with all the latest information and updates from this interesting upcoming industry and market, including the many new prototypes and displays recently unveiled by microLED developers.

Reading this report, you'll learn all about:

- Transparent OLED and MicroLED properties and advantages

- The transparent OLED and MicroLED industry

- What kind of transparent OLEDs are currently on the market

- The transparent OLED lighting market

The report package also provides:

- Transparent OLED display product listing

- A guide into buying transparent OLEDs

- The main challenges towards transparent displays

- Free updates for a year

This transparent displays market report provides a great introduction to transparent OLED and MicroLED technologies and covers everything you need to know about the market and industry now and in the future. This is a great guide for anyone who's thinking about adopting transparent displays in their products or that wants to understand this industry and market throughout.

Join us in April for a 2-day OLED innovations virtual event, as part of MicroLED-Connect!

MicroLED Connect, our hybrid event series focusing on the microLED industry, will be hosting a two-day virtual event focused on the OLED innovations, technologies, manufacturing, markets and more. The online event will take place on April 10-11, and will be an excellent opportunity to learn the latest OLED updates and connect with industry professionals on our excellent online event platform..

Today we have published the agenda for this event, with 20 exciting talks by leading OLED developers, supply chain companies and top-edge researchers. This will be an excellent opportunity to learn and connect with the OLED industry. You can register for the event here, with a yearly pass to MicroLED-Connect (with an option to also include entry into our September on-site event in Eindhoven, The Netherlands). Our members also gain access to past event recordings.

Samsung Semiconductors to take over Samsung's microLED microdisplay development

According to new reports from Korea, Samsung Electronics decided that from now on, Samsung Display will handle all OLED microdisplay projects, while Samsung Semiconductor (SSI, or specifically, the Compound Semiconductor Solutions team) will handle all microLED microdisplay development.

Samsung sees OLED microdisplays as the solution of choice for next-generation VR headsets, such as Apple's Vision Pro (that uses 1.4" 4K OLED microdisplays made by Sony), while microLEDs will power the more demanding AR applications.

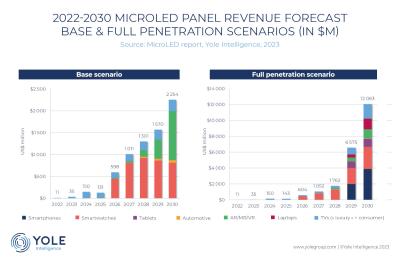

Yole sees significant microLED production in 2-3 years, with broader adoption in 5-10 years

Yole Intelligence has published its latest microLED market report, in which it sees commercial microLED production starting in 2-3 years, following several delays. In 5-10 years, adoption will increase.

In its base scenario, Yole sees microLED panel sales reaching $1.5 billion in 2029 and $2.2 billion in 2030, with almost 90% coming from wearables and AR/VR/MR microdisplays. The rest of the panels will be used in TV applications. If you want to hear more about Yole's microLED market insights, you are welcome to join the MicroLED-Connect online event later this month.

A spotlight on the Fraunhofer FEP: a MicroLED Industry Association member

We're happy to interview Dr. Uwe Vogel, the Deputy Director of the Fraunhofer FEP and the Division Director of the Fraunhofer's Microdisplays and Sensors division, as part of our series of interviews with MicroLED Industry Association members. The Fraunhofer Institute for Organic Electronics, Electron Beam and Plasma Technology (Fraunhofer FEP) is located in Dresden, Germany, and focuses on developing innovative solutions, technologies and processes for surface modification and organic electronics.

Hello Dr. Vogel. Can you introduce your company and technology?

The Fraunhofer Institute for Organic Electronics, Electron Beam and Plasma Technology FEP is one out of 76 institutes and research units of the Fraunhofer-Gesellschaft e. V., the largest European institution for applied research. The core competences of Fraunhofer FEP are electron beam technologies, vacuum thin film deposition techniques and technologies for organic electronics, microdisplay technology and sensors. Main activities target development and adaption of the thin film deposition technologies to a wide range of industrial applications. Fraunhofer FEP runs multiple pilot-scale vacuum coating systems.

Pagination

- Page 1

- Next page